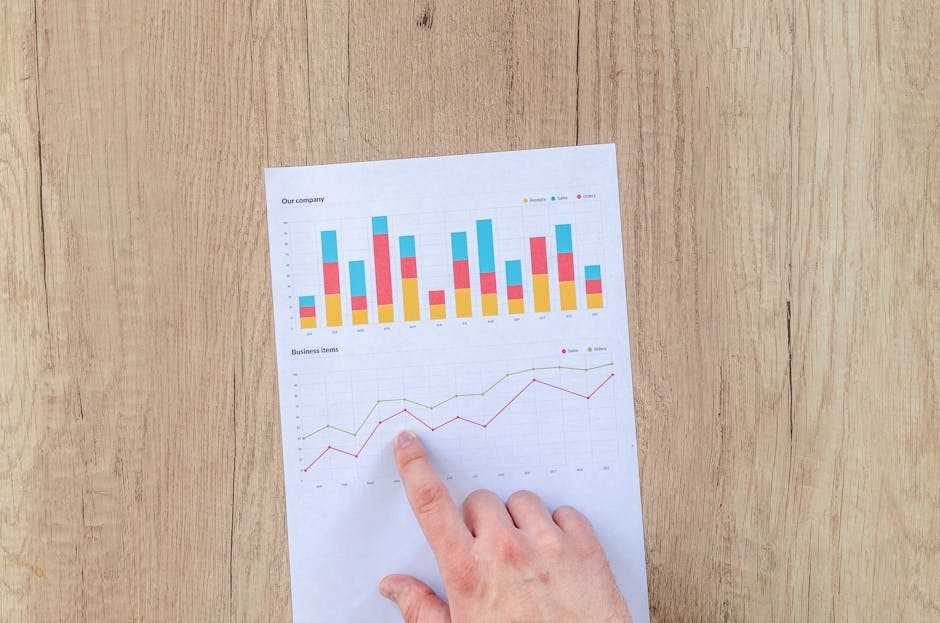

Big Picture Shifts Driving Market Growth

The pandemic didn’t just change how people live it changed where they want to live. After years of lockdowns, Zoom calls, and lifestyle reevaluations, the demand drivers in real estate look different than they did five years ago. Space, flexibility, and a lower cost of living are now front and center for buyers and renters alike.

Migration patterns are reshaping the map. People are leaving high cost, high density cities like San Francisco and New York and heading to places like Nashville, Phoenix, and Tampa. It’s not just about affordability it’s about quality of life, better weather, and looser zoning laws that make home ownership more accessible.

Remote work set this all in motion. As offices went optional, many workers realized they weren’t tied to any one location. Second tier cities that offer decent infrastructure, growing economies, and livable neighborhoods saw a big uptick. Places like Boise and Greenville that used to be off the radar are suddenly hotspots.

And while inflation and high interest rates may have cooled the pace of buying, they haven’t killed demand outright. If anything, buyers are just more selective and more value driven. They’re looking for markets where their dollar stretches farther, especially in areas with long term job growth and development plans in motion.

Real estate demand in 2024 isn’t fading it’s just shifting. Knowing where and why gives smart investors an edge.

Sun Belt Resurgence

The Sun Belt boom isn’t fading it’s evolving. Cities like Austin, Tampa, and Raleigh are still drawing in tech startups, remote professionals, and healthcare expansion like magnets. These metros have managed to maintain lower costs of living compared to coastal giants while seriously leveling up their job markets.

The real pull? Climate, taxes, and livability. Investors are noticing a consistent stream of new residents, especially young professionals and remote workers looking for space, sun, and opportunity. That means high rental demand, reduced vacancy rates, and more stability for long term plays even with rising interest rates.

Short term investors are locking in desirable zip codes before prices stretch too far, while institutional players are doubling down on build to rent projects. It’s not just a pandemic era trend anymore it’s a long term shift with roots in policy, demographics, and economics. The demand is here to stay. For savvy investors, Sun Belt markets are less about hype and more about momentum.

Investor Tips for Spotting the Next Big Market

If you’re looking to catch a real estate market before it takes off, focus less on headlines and more on low key signals hiding in plain sight. Start with the job market. If you see consistent employer growth especially in sectors like healthcare, tech, or logistics that’s a green flag. New or expanding companies bring workers. Workers need housing.

Next, keep an eye on local government rezoning proposals, mixed use developments, transit expansions. Zoning changes often lead market trends by a few years. If a town council is suddenly greenlighting denser residential builds near old warehouses, don’t wait for the ribbon cutting. Act early.

Walkability matters too. Areas adding new sidewalks, bike paths, or making downtowns more livable usually aren’t doing it just for fun. They’re prepping for growth, higher density, and likely rising values.

One final tell: housing supply. New projects are good, but they’re even better when they’re early. If you’re seeing developer interest in a spot that hasn’t been flooded yet, that’s your cue. Construction cranes are just momentum made visible.

For deeper insights and real time urbanization data, tap into our full urbanization trends guide.

Final Takeaways

It’s easy to get distracted by headlines and hashtagged hype. But the smartest investors know the hottest markets usually don’t come with the loudest buzz. They show up in places where fundamentals job growth, housing demand, infrastructure investment are trending in the right direction, even before the media catches on.

This is where niche knowledge pays off. Spend time understanding specific regions, not just what’s trending on finance Twitter or national news. Talk to local agents. Track school rankings, startup activity, zoning changes. Know who’s moving in and why.

The data is out there, but context is everything. Demographic shifts often start quietly and build fast. If you wait for a city to go viral, you’re late. Stay light on your feet, keep your research deep, and trust your read of the fundamentals. That’s how you find the next big market before everyone else does.

Roger Estes has played a crucial role in the development of Residence Resale Tactics, bringing his analytical skills and attention to detail to the project. As a dedicated helper, Roger has been instrumental in researching emerging market trends and ensuring the platform stays ahead of the curve in providing up-to-date real estate information. His commitment to accuracy and relevance has been essential in creating a resource that real estate professionals and homeowners can rely on for practical guidance.

Roger's contributions go beyond just research; his proactive approach and collaborative spirit have fostered a productive working environment within the team. His efforts have helped shape the platform's strategic direction, allowing Residence Resale Tactics to deliver content that is both insightful and actionable, thereby enhancing its reputation as a trusted authority in the real estate industry.

Roger Estes has played a crucial role in the development of Residence Resale Tactics, bringing his analytical skills and attention to detail to the project. As a dedicated helper, Roger has been instrumental in researching emerging market trends and ensuring the platform stays ahead of the curve in providing up-to-date real estate information. His commitment to accuracy and relevance has been essential in creating a resource that real estate professionals and homeowners can rely on for practical guidance.

Roger's contributions go beyond just research; his proactive approach and collaborative spirit have fostered a productive working environment within the team. His efforts have helped shape the platform's strategic direction, allowing Residence Resale Tactics to deliver content that is both insightful and actionable, thereby enhancing its reputation as a trusted authority in the real estate industry.